If you are buying or selling a rental property, I will help you comply with the Wisconsin Rental Weatherization program. This was formally known as a DIHLR Inspection but has since changed. Click here for the brochure and requirements to get you started. Click here to search for a property for compliance. I will issue your certification when your rental property meets the requirements. Greg Liebig is a licensed Wisconsin Rental Weatherization Inspector. More information

Background

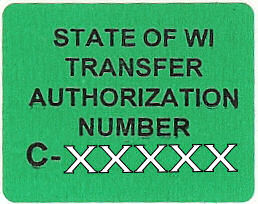

This program went into effect on January 1, 1985. Pursuant to s. 101.122, Stats., the purpose of this chapter is to establish minimum energy efficiency requirements for rental units that must be met before the ownership of the rental unit may be transferred.Since then, most residential rental properties have had to meet minimum standards for energy efficiency. The register of deeds will not record the transfer of the property unless the following conditions are met:

- An inspector has certified the property; or

- The buyer has filed a Stipulation to bring it up to Code within a year; or

- The property or transfer is shown on the Real Estate Transfer Return to be excluded from the Code; or

- The buyer has filed a Waiver with the Department of Commerce stating that the building will be demolished within two years.

Here's a link to all of the State forms you may need.

Here's a link to all of the State forms you may need.

State Requirements and Property Search

The first place to start is to review Wisconsin Requirements. Click here for the brochure. A property only needs one certification and it is good for the life of the property. You can click here to search for a property to see if there is an active stipulation or if a certification has been issued. Please contact us if you would like more information or to schedule the inspection.

2008 Rental Unit Energy Efficiency Program Changes

![]() Rental Unit Energy Efficiency Program Changes Effective May 1, 2008. The major changes to the program are:

Rental Unit Energy Efficiency Program Changes Effective May 1, 2008. The major changes to the program are:

- Elimination of the Waiver and Stipulation Fees

- Increasing the Fee of the Certification Transfer stamp to $43.00

- Increasing the Maximum Allowable Inspection

- Fess Up to 2 rental units . . . . . . . . . . . . . . . . . . . . . . $250.00

- Three to 8 rental units . . . . . . $250.00 plus $50 for each additional rental unit over 2 rental units.

- Over 8 rental units . . . . . . . . $250.00 plus $25 for each additional rental unit over 8 rental units.

- Reorganize all of the requirements under Comm 67 by grouping them into subchapters relating to application, definitions, administration and enforcement, and technical requirements.

- Elimination of the Cost Payback Exemption

- Clarify the definition of "owner-occupied" by stating the owner must occupy a dwelling unit exclusively as the primary or secondary residence within the first year immediately after the date of transfer of the dwelling unit. It also clarifies the owner may claim up to 2 residences.

- Clarify the 2-year time period granted for a waiver starts from the date the waiver is validated, and include a requirement that states a rental unit with an expired waiver may not be transferred.

- Clarify that an owner of a rental unit must bring the unit into compliance with the energy requirements no later than one year after the stipulation was validated.

- Clarify the stipulation requirements, and include an option that the owner may bring the rental unit into compliance using either the code in effect at the time the stipulation was issued or using the current code requirements.

- Clarify the rules relating to insulation of box sills to permit foam plastic insulation to be used without the required thermal barrier.

- Clarify the rules relating to insulation of ducts and pipes to include vented attic spaces.

- Change the requirements relating to domestic hot water pipes to domestic water heater pipes, and require the insulation of only the supply pipes for non-circulating hot and cold water pipes in vented crawl spaces.

The new rules do not change the properties that are currently excluded from coverage. The rules for mixed use buildings (for example, apartments above retail space) remain unchanged as well. Finally, the new rules still require compliance for properties acquired for re-sale and for properties acquired for rehabilitation (even if the properties are vacant during the renovation work), if the properties are not re-sold within one year of the transfer.